nj property tax relief for seniors

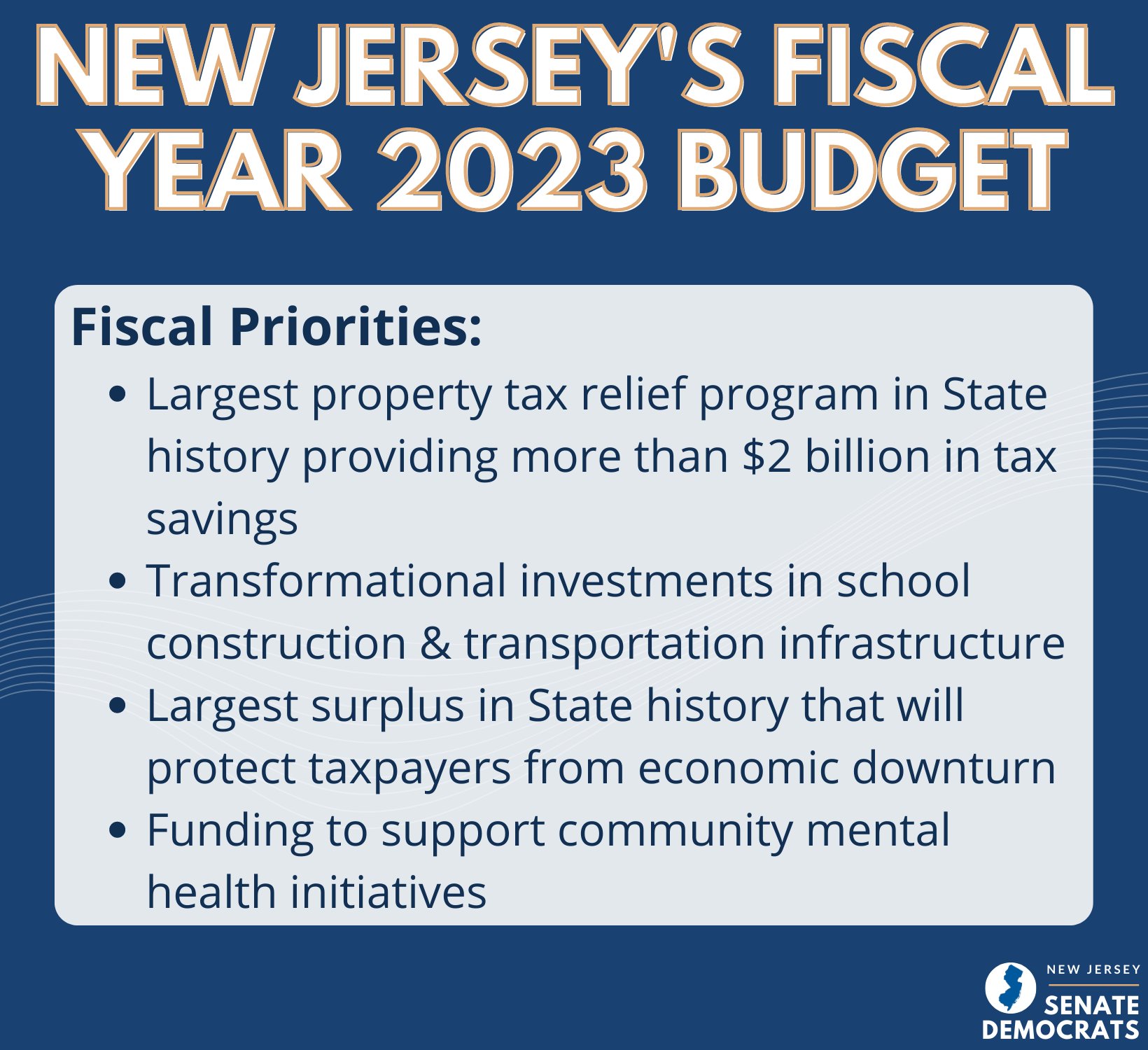

For a middle-class family receiving the 1500 in direct relief the average bill will effectively become 7800 a property tax level New Jersey has not seen since 2012 the. See If You Qualify For IRS Fresh Start Program.

Murphy Announces Details Of Property Tax Relief Program Whyy

For a middle-class family getting that 1500 in direct relief that average bill would become 7800 Murphy.

. If you are age 65 or older or disabled and have been a New Jersey resident for at least one year you may be eligible for an annual 250 property tax deduction. The state of New Jersey is offering a new property tax relief program that is replacing the previous Homestead Benefit program. It was founded in 2000 and has since become a participant in the American.

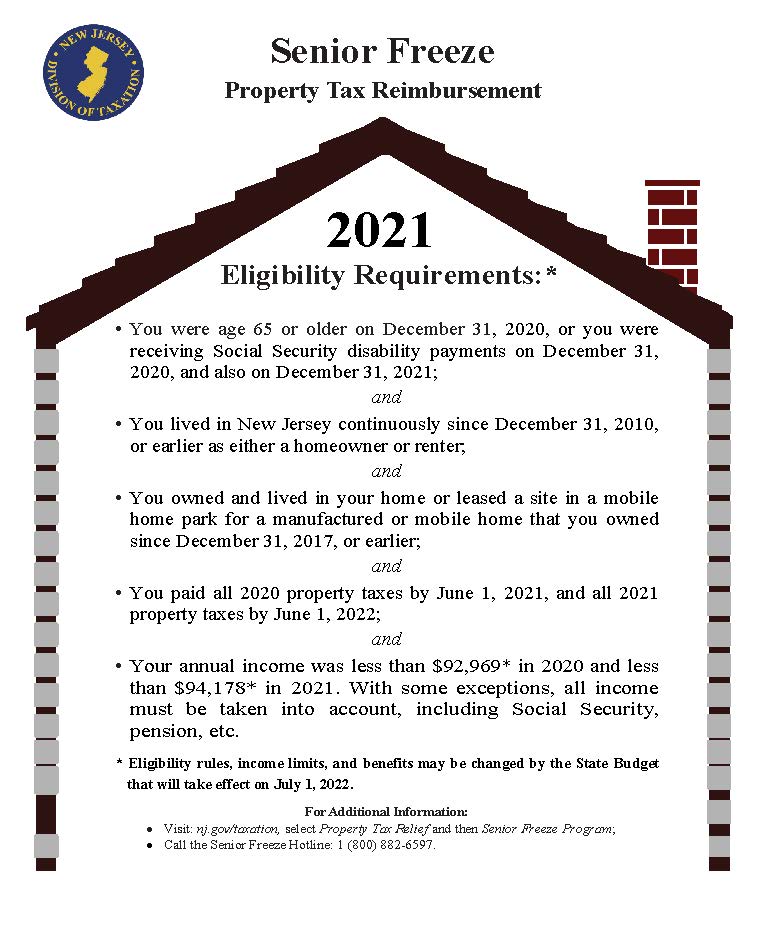

Phil Murphy and his fellow Democrats who lead the. Ad Apply For Tax Forgiveness and get help through the process. The Senior Freeze program which reimburses eligible seniors and disabled residents for increases in their property taxes or mobile home fees is still available.

Senior and disabled homeowners in that category would. The state of New Jersey provides senior citizens and people with disabilities with some relief regarding property taxes. Ad Based On Circumstances You May Already Qualify For Tax Relief.

Alternate documents to send as proof can be found. 3 days ago Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281 Senior Freeze Home. Stay up to date on vaccine information.

Prior to the new 51 billion budget the average property tax benefit was 626 with eligibility limited to homeowners making 75000 or less if under 65 and not blind or disabled. Ad Looking for senior property tax freeze nj. If you qualify and have not received this application call 1-800-882-6597.

You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Find updated content daily for senior property tax freeze nj. You will get the difference.

In 2021 the average New Jersey property tax bill was about 9300. Under the recently enacted New Jersey School Assessment Valuation Exemption Relief and Homestead Property Tax Rebate Act NJ SAVER and Homestead Rebate Act PL1999 c63. COVID-19 is still active.

COVID-19 is still active. About the Company Property Tax Relief For Nj Seniors CuraDebt is a debt relief company from Hollywood Florida. Property Tax Relief Forms.

The verification form is your proof of property taxes due and paid. Covid19njgov Call NJPIES Call Center for medical information. The Affordable New Jersey Communities.

The Property Tax Reimbursement Program is designed to reimburse senior citizens age 65 and older and disabled persons for property. Tax Reimbursement for Senior Citizens. Stay up to date on vaccine information.

About two million New Jersey homeowners and renters would get larger property tax rebates than originally planned as Gov. This property tax relief program does not actually freeze your taxes but will reimburse you for any property tax increases you have once youre in the program. Covid19njgov Call NJPIES Call Center for medical information related to COVID.

Free Case Review Begin Online. NJ Division of Taxation - Senior Freeze Property Tax. Under Murphys plan the smallest benefits would go to homeowners making between 150000 and 250000.

Applications for the homeowner benefit are not available on this site for printing. If you moved from one New Jersey property to another and received a reimbursement for your previous residence for the last full year you lived there you may qualify for an exception to re. Local Property Tax Relief Programs.

If you meet certain requirements you may have the right to claim a.

Documentation For Loan Against Property What You Need To Know Property Tax Tax Debt Relief Loan

Murphy Signs 50 6 Billion Budget With Property Tax Relief

Ending Delays For Senior Freeze Beneficiaries Nj Spotlight News

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota States

Here Are The Most Tax Friendly States For Retirees Marketwatch Retirement Retirement Income Retirement Planning

Nj Property Tax Relief Program Updates Access Wealth

Nj Senate Democrats Njsendems Twitter

New Jersey Has The Highest Effective Rate On Owner Occupied Property At 2 21 Percent Followed Closely By Illinois 2 05 Percent And N Property Tax Tax States

Stimulus Update New Jersey Homeowners Could Earn Up To 1 500 In Property Tax Relief Who Qualifies Gobankingrates

Nj Property Tax Relief Program Updates Access Wealth

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

![]()

2021 Senior Freeze Program Disabled Person Property Tax Reimbursement Filing Deadline October 31 2022 Updated 06 28 2022 Township Of Little Falls

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Housing Market Insights For 2018 Housing Market Berkeley Heights Home Mortgage

Printform Finance Incoming Call Screenshot Property Tax

Nj Dept Of Treasury Njtreasury Twitter

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota States